Forward Integration Can Mean Which of theã¢â‚¬â€¹ Following?

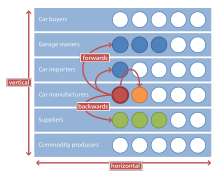

A diagram illustrating horizontal integration and contrasting information technology with vertical integration.

In microeconomics, management, and international political economy, vertical integration is an system in which the supply concatenation of a visitor is integrated and owned by that company. Usually each fellow member of the supply chain produces a different product or (market-specific) service, and the products combine to satisfy a common need. It is assorted with horizontal integration, where in a company produces several items that are related to one another. Vertical integration has also described direction styles that bring large portions of the supply concatenation non merely under a common buying but besides into one corporation (as in the 1920s when the Ford River Rouge Complex began making much of its own steel rather than ownership information technology from suppliers).

Vertical integration and expansion is desired because it secures supplies needed by the firm to produce its product and the market needed to sell the product. Vertical integration and expansion tin get undesirable when its actions become anti-competitive and impede free competition in an open market. Vertical integration is i method of avoiding the hold-upwards problem. A monopoly produced through vertical integration is chosen a vertical monopoly.

Vertical expansion [edit]

Replica of an East Indiaman of the Dutch East India Company/United East India Company (VOC). In terms of the global supply chain and vertical integration/expansion, the VOC was an early pioneering model at the dawn of modern commercialism, particularly in the 17th and 18th centuries.[1] [2]

Vertical integration is often closely associated with vertical expansion which, in economics, is the growth of a business enterprise through the acquisition of companies that produce the intermediate appurtenances needed by the business concern or help market and distribute its product. Such expansion is desired because information technology secures the supplies needed by the firm to produce its product and the market needed to sell the product. Such expansion tin go undesirable when its deportment become anti-competitive and impede gratuitous contest in an open up market place.

The result is a more than efficient business with lower costs and more than profits. On the undesirable side, when vertical expansion leads toward monopolistic control of a product or service then regulative activity may be required to rectify anti-competitive behavior. Related to vertical expansion is lateral expansion, which is the growth of a business organisation enterprise through the acquisition of similar firms, in the hope of achieving economies of scale.

Vertical expansion is also known as a vertical acquisition. Vertical expansion or acquisitions can likewise be used to increment sales and to gain market ability. The acquisition of DirecTV by News Corporation is an example of forwarding vertical expansion or conquering. DirecTV is a satellite Television company through which News Corporation can distribute more than of its media content: news, movies, and television shows. The acquisition of NBC by Comcast is an case of astern vertical integration. For example, in the United States, protecting the public from communications monopolies that tin be congenital in this style is ane of the missions of the Federal Communications Commission.

Three types of vertical integration [edit]

Reverse to horizontal integration, which is a consolidation of many firms that handle the aforementioned part of the production process, vertical integration is typified by 1 firm engaged in different parts of production (e.one thousand., growing raw materials, manufacturing, transporting, marketing, and/or retailing). Vertical integration is the degree to which a firm owns its upstream suppliers and its downstream buyers.

At that place are three varieties of vertical integration: backward (upstream) vertical integration, forrad (downstream) vertical integration, and balanced (both upstream and downstream) vertical integration.

- A visitor exhibits backward vertical integration when information technology controls subsidiaries that produce some of the inputs used in the production of its products. For example, an motorcar company may own a tire visitor, a drinking glass company, and a metal company. Command of these 3 subsidiaries is intended to create a stable supply of inputs and ensure a consistent quality in their final product. Information technology was the main concern approach of Ford and other automobile companies in the 1920s, who sought to minimize costs past integrating the product of cars and car parts, every bit exemplified in the Ford River Rouge Circuitous.

- A visitor tends toward frontward vertical integration when it controls distribution centers and retailers where its products are sold. An example is a brewing company that owns and controls a number of bars or pubs.

Disintermediation is a grade of vertical integration when purchasing departments take over the former part of wholesalers to source products.[3]

Problems and benefits [edit]

There are internal and external society-wide gains and losses stemming from vertical integration, which vary according to the state of technology in the industries involved, roughly respective to the stages of the industry lifecycle.[ clarification needed ] [ citation needed ] Static engineering represents the simplest case, where the gains and losses have been studied extensively.[ citation needed ] A vertically integrated company commonly fails when transactions within the market are too risky or the contracts to support these risks are likewise costly to administer, such as frequent transactions and a small number of buyers and sellers.

Internal gains [edit]

- Lower transaction costs

- Synchronization of supply and demand along the chain of products

- Lower uncertainty and higher investment

- Ability to monopolize marketplace throughout the chain by market foreclosure

- Strategic independence (especially if important inputs are rare or highly volatile in price, such as rare-globe metals).

Internal losses [edit]

- Higher monetary and organizational costs of switching to other suppliers/buyers

- Weaker motivation for adept functioning at the get-go of the supply chain since sales are guaranteed and poor quality may be composite into other inputs at later manufacturing stages

- Specific investment

Benefits to society [edit]

- Better opportunities for investment growth through reduced uncertainty[ citation needed ]

- Local companies are oftentimes better positioned against foreign competition[ commendation needed ]

- Lower consumer prices by reducing markup from intermediaries[4]

Losses to order [edit]

- Monopolization of markets

- Rigid organizational structure

- Manipulation of prices (if market power is established)

- Loss of tax revenue equally fewer intermediary transactions are made[ citation needed ]

Selected examples [edit]

Birdseye [edit]

During a hunting trip American explorer and scientist Clarence Birdseye discovered the benign effects of "quick-freezing". For instance, fish caught a few days previously that were kept in water ice remained in perfect condition.

In 1924, Clarence Birdseye patented the "Birdseye Plate Froster" and established the General Seafood Corporation. In 1929, Birdseye's company and the patent were bought by Postum Cereals and Goldman Sachs Trading Corporation. Information technology was later known equally General Foods. They kept the Birdseye name, which was dissever into two words (Birds centre) for utilize as a trademark. Birdseye was paid $twenty million for the patents and $two million for the avails.

Birds Eye was one of the pioneers in the frozen food manufacture. During these times, at that place was not a well-developed infrastructure to produce and sell frozen foods. Hence Birds Eye developed its ain system by using vertical integration. Members of the supply chain, such as farmers and small food retailers, couldn't afford the high cost of equipment, and then Birdseye provided it to them.

Until now, Birds Eye has faded slowly[ citation needed ] because they have fixed costs associated with vertical integration, such every bit property, plants, and equipment that cannot be reduced significantly when product needs subtract. The Birds Eye company used vertical integration to create a larger organization construction with more than levels of control. This produced a slower information processing rate, with the side effect of making the company then slow that information technology couldn't react quickly. Birds Eye didn't have advantage of the growth of supermarkets until x years after the contest did. The already-developed infrastructure did not permit Birdseye to quickly react to market changes.

Alibaba [edit]

In order to increase profits and gain more than market share, Alibaba, a China-based visitor, has implemented vertical integration deepening its visitor holdings to more than the e-commerce platform. Alibaba has congenital its leadership in the market by gradually acquiring complementary companies in a variety of industries including delivery and payments.

Steel and oil [edit]

Ane of the earliest, largest and nigh famous examples of vertical integration was the Carnegie Steel company. The company controlled non simply the mills where the steel was made, merely too the mines where the fe ore was extracted, the coal mines that supplied the coal, the ships that transported the iron ore and the railroads that transported the coal to the factory, the coke ovens where the coal was coked, etc. The visitor focused heavily on developing talent internally from the bottom up, rather than importing it from other companies.[5] [ full commendation needed ] Later, Carnegie established an plant of higher learning to teach the steel processes to the next generation.

Oil companies, both multinational (such as ExxonMobil, Royal Dutch Shell, ConocoPhillips or BP) and national (e.g., Petronas) often adopt a vertically integrated structure, meaning that they are active along the entire supply chain from locating deposits, drilling and extracting crude oil, transporting it around the world, refining information technology into petroleum products such equally petrol/gasoline, to distributing the fuel to company-owned retail stations, for auction to consumers.[ citation needed ] Standard Oil is a famous case of both horizontal and vertical integration, combining extraction, transport, refinement, wholesale distribution, and retail sales at company-owned gas stations.

Telecommunications and computing [edit]

Phone companies in most of the 20th century, especially the largest (the Bell System) were integrated, making their own telephones, telephone cables, phone exchange equipment and other supplies.[half-dozen]

Entertainment [edit]

From the early on 1920s through the early 1950s, the American move moving-picture show had evolved into an manufacture controlled by a few companies, a condition known equally a "mature oligopoly", every bit it was led past eight major film studios, the most powerful of which were the "Big V" studios: MGM, Warner Brothers, 20th Century Fox, Paramount Pictures, and RKO.[seven] These studios were fully integrated, not merely producing and distributing films, but besides operating their own movie theaters; the "Little 3", Universal Studios, Columbia Pictures, and United Artists, produced and distributed characteristic films simply did not own theaters.[ commendation needed ]

The outcome of vertical integration (too known as common ownership) has been the chief focus of policy makers because of the possibility of anti-competitive behaviors affiliated with market place influence. For example, in The states v. Paramount Pictures, Inc., the Supreme Court ordered the v vertically integrated studios to sell off their theater chains and all trade practices were prohibited (United States v. Paramount Pictures, Inc., 1948).[8] The prevalence of vertical integration wholly predetermined the relationships between both studios and networks[ description needed ] and modified criteria in financing. Networks began arranging content initiated by normally owned studios and stipulated a portion of the syndication revenues in order for a show to gain a spot on the schedule if it was produced by a studio without common ownership.[9] In response, the studios fundamentally changed the way they made movies and did business. Defective the financial resources and contract talent they once controlled, the studios at present relied on contained producers supplying some portion of the budget in substitution for distribution rights.[10]

Certain media conglomerates may, in a similar manner, ain television receiver broadcasters (either over-the-air or on cable), production companies that produce content for their networks, and also ain the services that distribute their content to viewers (such equally television and internet service providers). AT&T, Bell Canada, Comcast, Sky plc, and Rogers Communications are vertically integrated in such a manner—operating media subsidiaries (such equally WarnerMedia, Bell Media, NBCUniversal, and Rogers Media), and provide "triple play" services of television set, internet, and phone service in some markets (such as Bong Satellite TV/Bell Internet, Rogers Cablevision, Xfinity, and Sky'south satellite Boob tube and cyberspace services). Additionally, Bell and Rogers own wireless providers, Bong Mobility and Rogers Wireless, while Comcast is partnered with Verizon Wireless for an Xfinity-branded MVNO. Similarly, Sony has media holdings through its Sony Pictures partition, including film and television content, every bit well every bit telly channels, but is also a manufacturer of consumer electronics that can be used to play content from itself and others, including televisions, phones, and PlayStation video game consoles. AT&T is the first ever vertical integration where a mobile phone company and a motion-picture show studio company are nether same umbrella.

Agriculture [edit]

Vertical integration through production and marketing contracts accept also go the dominant model for livestock production. Currently, 90% of poultry, 69% of hogs, and 29% of cattle are contractually produced through vertical integration.[eleven] The USDA supports vertical integration considering it has increased food productivity. However, "... contractors receive a large share of subcontract receipts, formerly causeless to go to the operator'south family unit".[12]

Under production contracts, growers raise animals endemic by integrators. Farm contracts contain detailed conditions for growers, who are paid based on how efficiently they utilize feed, provided past the integrator, to raise the animals. The contract dictates how to construct the facilities, how to feed, business firm, and medicate the animals, and how to handle manure and dispose of carcasses. Generally, the contract also shields the integrator from liability.[11] Jim Hightower, in his book, Swallow Your Heart Out,[13] discusses this liability function enacted past large food companies. He finds that in many cases of agricultural vertical integration, the integrator (nutrient visitor) denies the farmer the right of entrepreneurship. This means that the farmer can only sell nether and to the integrator. These restrictions on specified growth, Hightower argues, strips the selling and producing power of the farmer. The producer is ultimately limited by the established standards of the integrator. Nonetheless, at the aforementioned time, the integrator still keeps the responsibility connected to the farmer. Hightower sees this as ownership without reliability.[xiv]

Under marketing contracts, growers concur in advance to sell their animals to integrators under an agreed price arrangement. Generally, these contracts shield the integrator from liability for the grower'due south deportment and the only negotiable item is a cost.[11]

Automotive manufacture [edit]

In the United States new automobiles tin not be sold at dealerships owned past the same company that produced them but are protected past state franchise laws.[15]

Eyewear [edit]

EssilorLuxottica, the visitor that merged with Essilor and Luxottica, occupies upwards to 30% of the global market share as well equally representing billions of pairs of lenses and frames sold annually. Before the merger, Luxottica likewise endemic 80% of the market place share of companies that produce corrective and protective eyewear every bit well as owning many retailers, optical departments at Target and Sears, and key eye insurance groups, such as EyeMed, many of which are already part of the now merged company.[16] [17] [eighteen] [19]

Health intendance [edit]

In the U.s., major vertical mergers have included CVS Health's purchase of Aetna, and Cigna'south purchase of Express Scripts.

General retail [edit]

Amazon.com has been criticized for being anti-competitive as both an owner and participant of its ascendant online marketplace. In part products, Sycamore Partners owns both Staples, Inc., a major retailer, and Essendant, a dominant wholesaler.

Economic theory [edit]

In economical theory, vertical integration has been studied in the literature on incomplete contracts that was developed by Oliver Hart and his coauthors.[20] [21] Consider a seller of an intermediate production that is used by a buyer to produce a final product. The intermediate production tin can only be produced with the assistance of specific concrete assets (due east.g., machines, buildings). Should the buyer own the assets (vertical integration) or should the seller own the assets (non-integration)? Suppose that today the parties have to make relationship-specific investments. Since today consummate contracts cannot exist written, the two parties will negotiate tomorrow about how to divide the returns of the investments. Since the owner is in a better bargaining position, he will have stronger incentives to invest. Hence, whether vertical integration is desirable or not depends on whose investments are more than important. Hart'south theory has been extended by several authors. For instance, DeMeza and Lockwood (1998) accept studied different bargaining games,[22] while Schmitz (2006) has introduced asymmetric information into the incomplete contracting setup.[23] In these extended models, vertical integration can sometimes be optimal fifty-fifty if only the seller has to brand an investment decision.

References [edit]

- ^ Unoki, Ko: Mergers, Acquisitions and Global Empires: Tolerance, Diversity and the Success of M&A. (New York: Routledge, 2013), pp. 34–64

- ^ Grenville, Stephen (3 November 2017). "The showtime global supply chain". Lowy Institute. Retrieved 18 May 2018.

Stephen Grenville (2017): "Here [17th-century Ternate, North Maluku, Indonesia], surely, was a very early, fully operational manifestation of international integration, the embryonic form of today'southward ubiquitous globalisation. Nosotros would recognise its constituent elements. Here was the tenuous only well-structured supply-chain, extended all the way from Banda to Amsterdam, via numerous ports and functionaries, administered with fell efficiency by the Dutch E Bharat Visitor, perhaps the first business concern organisation that bears resemblance to today'south multinational corporations. The company raised coin by issuing shares. Information technology had the commencement widely-recognised commercial logo. Fifty-fifty without today'south computers, the company'southward officials were linked through a hierarchy of regular detailed reporting and accounting. Product was brought together in plantations and processed in 'factories'. Near-subsistence agriculture was replaced with scale and quality control, supervised past the perkeniers with an incentivising profit-sharing deal with the visitor. Customer feedback was insistently relayed to producers: 'small nutmegs are of no value'. This mighty machine produced 3000 tons of nutmeg annually and transported it across hazardous waters to evangelize information technology to the burghers of Holland and on to the rest of Europe's spice-hungry upper-class. Advert hoc trade between nations, with goods passing through many hands, many owners and many markets, was replaced past 'straight-through' processing by a single entity – the Dutch East Republic of india Visitor."

- ^ Lazonick, William; David J. Teece (2012). Management Innovation: Essays in the Spirit of Alfred D. Chandler, Jr. OUP Oxford. p. 150. ISBN978-0199695683 . Retrieved 17 January 2017.

- ^ DOJ and FTC Advise Highly Anticipated Vertical Merger Guidelines

- ^ Folsom, Burton The Myth of the Robber Barons 5th edition. 2007. pg. 65. ISBN 978-0963020314. "simply we can develop power and hold information technology in our service. Every yr should be marked by the promotion of one or more of our young men."

- ^ Irwin, Manley (3 Feb 1968). "Vertical Integration and the Communication Equipment Manufacture Alternatives for Public Policy". scholarship.police force.cornell.edu . Retrieved 2 June 2019.

- ^ John Alberti (27 Nov 2014). Screen Ages: A Survey of American Cinema. Routledge. pp. 108–. ISBN978-i-317-65028-7.

- ^ Oba, Goro; Chan-Olmstead, Sylvia (2006). "Cocky-Dealing or Market Transaction?: An Exploratory Study of Vertical Integration in the U.Due south. Television Syndication Marketplace". Journal of Media Economics. 19 (2): 99–118. doi:x.1207/s15327736me1902_2. S2CID 153386365.

- ^ Lotz, Amanda D. (2007) "The Television Volition Be Revolutionized". New York, NY: New York University Press. p.87

- ^ McDonald, P. & Wasko, J. (2008). The Contemporary Hollywood Film Manufacture. Australia: Blackwell Publishing Ltd. pp. 14–17. ISBN9781405133876.

- ^ a b c Paul Stokstad, Enforcing Environmental Law in an Unequal Market: The Case of Concentrated Animal Feeding Operations, 15 Mo. Envtl. 50. & Pol'y Rev. 229, 234-36 (Spring 2008)

- ^ "USDA ERS - Farmers' Use of Marketing and Production Contracts". Ers.usda.gov. Archived from the original on 24 April 2015. Retrieved 24 April 2015.

- ^ Hightower, Jim (21 October 2009). Eat Your Heart Out: Food Profiteering in America - Jim Hightower - Google Books. ISBN9780517524541 . Retrieved 24 April 2015.

- ^ Hightower, Jim. Eat Your Middle Out, 1975, Crown Publishing. pg 162-168, ISBN 978-0517524541

- ^ Surowiecki, James (four September 2006). "Dealer'south Choice". The New Yorker . Retrieved 1 Oct 2016.

- ^ "Sticker daze: Why are glasses so expensive?". 60 Minutes. CBS News. seven October 2012. Retrieved nineteen October 2012.

- ^ Goodman, Andrew (16 July 2014). "There'southward More to Ray-Ban and Oakley Than Meets the Eye". Forbes . Retrieved 1 Oct 2016.

- ^ Swanson, Ana (10 September 2014). "Encounter the Iv-Eyed, Eight-Tentacled Monopoly That is Making Your Glasses And so Expensive". Forbes . Retrieved i October 2016.

- ^ Knight, Sam (10 May 2018). "The spectacular power of Big Lens | The long read" – via www.theguardian.com.

- ^ Grossman, Sanford J.; Hart, Oliver D. (1986). "The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration". Periodical of Political Economy. 94 (4): 691–719. doi:10.1086/261404. ISSN 0022-3808.

- ^ Hart, Oliver; Moore, John (1990). "Holding Rights and the Nature of the Firm". Journal of Political Economic system. 98 (half dozen): 1119–1158. doi:x.1086/261729. ISSN 0022-3808. S2CID 15892859.

- ^ de Meza, D.; Lockwood, B. (1998). "Does Asset Ownership Always Motivate Managers? Outside Options and the Holding Rights Theory of the Firm". The Quarterly Journal of Economic science. 113 (2): 361–386. doi:ten.1162/003355398555621. ISSN 0033-5533.

- ^ Schmitz, Patrick W. (2006). "Information Gathering, Transaction Costs, and the Holding Rights Approach". American Economical Review. 96 (1): 422–434. doi:10.1257/000282806776157722. S2CID 154717219.

Bibliography [edit]

- Kathryn H. (1986). "Matching Vertical Integration strategies". Strategic Management Journal. 7: 535–555. doi:10.1002/smj.4250070605.

- Matthew Lewis (2013). "On Apple And Vertical Integration". Retrieved 11 Apr 2015.

- Paul Cole-Ingait; Demand Media (2013). "Vertical Integration Examples in the Smartphone Industry". Retrieved 11 April 2015.

- Robert D. Buzzell (January 1983). "Is Vertical Integration Assisting?". Retrieved 11 April 2015.

- Wharton (2012). "How Apple Made 'Vertical Integration' Hot Again — Also Hot, Maybe". Time . Retrieved xiii April 2015.

- "Thought Vertical Integration". 30 March 2009. Retrieved 12 April 2015.

- Grossman SJ, Hart OD (1986). "The costs and benefits of ownership: A theory of vertical and lateral integration" (PDF). The Journal of Political Economic system. 94 (4): 691–719. doi:10.1086/261404.

- "Iglo History". Archived from the original on 3 May 2015. Retrieved two May 2015.

Further reading [edit]

- Bramwell G. Rudd, 2014, "Courtaulds and the Hosiery & Knitwear Industry," Lancaster, PA:Carnegie.

- Joseph R. Conlin, 2007, "Vertical Integration," in The American Past: A Survey of American History, p. 457, Belmont, CA:Thompson Wadsworth.

- Martin Yard. Perry, 1988, "Vertical Integration: Determinants and Effects," Chapter 4 in Handbook of Industrial Organization, Due north Holland.[ full commendation needed ]

Source: https://en.wikipedia.org/wiki/Vertical_integration

0 Response to "Forward Integration Can Mean Which of theã¢â‚¬â€¹ Following?"

Postar um comentário